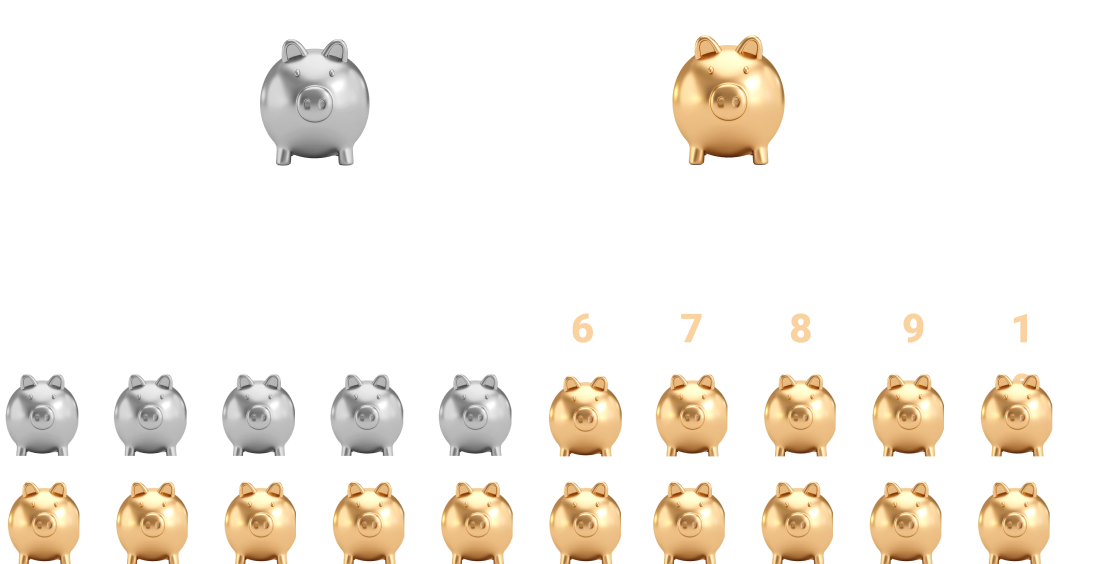

By adding the bank’s contributions over a 10-year period, this policy will maximize higher growth, creating opportunities to take advantage of accumulating interest. In the 15th year, depending on the growth rate, the bank will repay the entire amount borrowed along with the policy’s interest. After the loan has been paid off, the policy will be released, and customers can receive annual distributions that will supplement their retirement fund. If a participant unfortunately passes away before the collateral assets are released, the bank will repay the outstanding debt before compensating the customer.